PART TWO

In the first part of this article, we looked at why Tauranga City Council needs to slow down and re-set its Draft 2024 Long Term Plan (LTP), to account for the new government’s policies on three waters and transport.

We now look at the current Draft Plan and assess the basic financials. What is the city’s debt level, how affordable are our rates, and is the plan financially prudent and sustainable?

In its own words, Tauranga City Council “is one of New Zealand’s most indebted councils with total debt of $1.1b expected at the commencement of the LTP”. That excludes the $177 million of (more expensive) Transport IFF debt that sits ‘off its books’ (i.e. not on the organisation’s balance sheet).

In other words, before TCC even starts to pay for the projects in this 2024-34 LTP (such as the Civic Centre museum and exhibition centre, Memorial Park upgrade, Cameron Rd stage 2 and possibly a new stadium), ratepayers already owe $1.277 billion.

By July 2025, the official (on the books) debt is projected to reach $1.26 billion, plus the $177 million Transport IFF debt, plus another $151.5 million Civic Centre IFF (off the books) debt – which makes a grand total of $1,590,113,000. That’s $1.59 billion of net debt in 1.5 years from now.

Meanwhile, TCC is looking to “sell our two carparking buildings to raise capital for other city projects/help pay for the city centre transformation”. In other words, to help keep debt at that massive $1.59 billion by June 2025, the council is planning to sell two of its most heavily used assets, which people actually pay to use.

If TCC sells those buildings, parking prices will increase. If TCC doesn’t sell them and forges ahead with the civic centre, the debt will be even higher.

Interestingly, the Council’s projected debt level in 2034, the final year of this 10-year plan, is ‘only’ $1.34 billion. In other words, not much more than the $1.26 billion in June 2025.

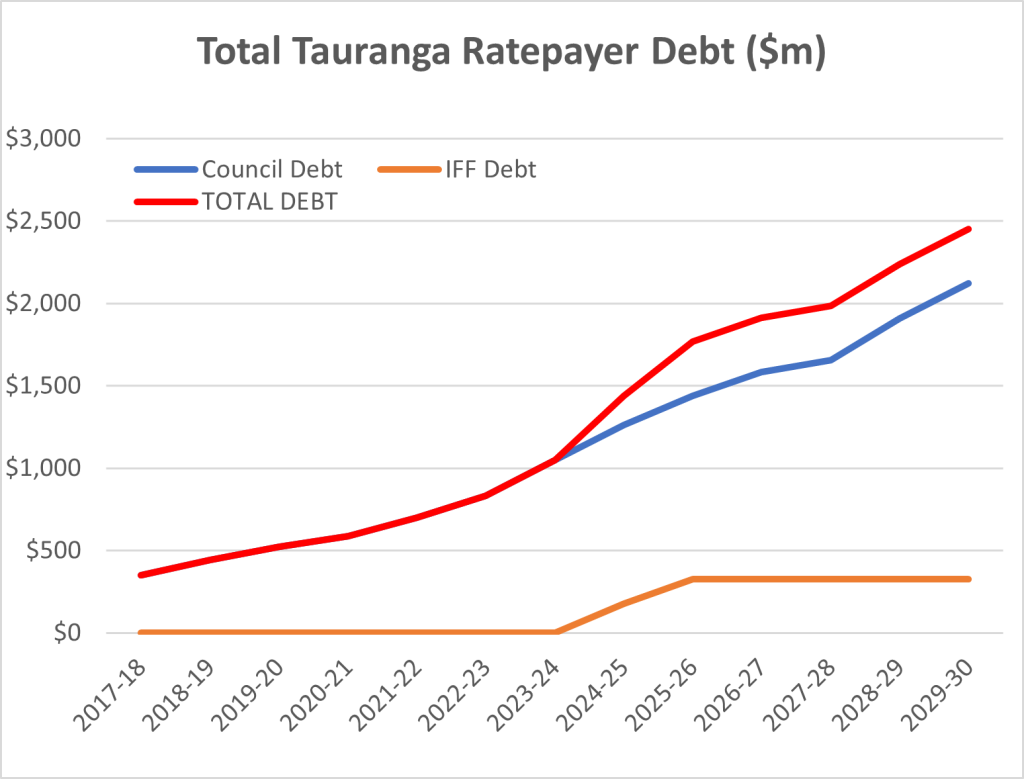

However, the reason for that relatively small increase in debt is that TCC has left all three waters debt and capital spending out of its plan. Now that Labour’s three waters reforms are being scrapped and waters infrastructure will still need to be funded by councils (or otherwise by ratepayers), total Tauranga ratepayer debt is projected by TCC to be nearly $2.5 billion by the end of the decade.

| Ratepayer Debt | 2021-22 | 2022-23 | 2023-24 | 2024-25 | 2025-26 | 2026-27 | 2027-28 | 2028-29 | 2029-30 |

| Council Debt | $701 | $833 | $1,049 | $1,262 | $1,440 | $1,584 | $1,657 | $1,909 | $2,123 |

| IFF Debt | $0 | $0 | $0 | $177 | $329 | $329 | $329 | $329 | $329 |

| TOTAL | $701 | $833 | $1,049 | $1,439 | $1,769 | $1,913 | $1,986 | $2,238 | $2,452 |

Worse still, TCC clearly states that it will breach Council’s debt limit by the end of this decade if they have to fund three waters. TCC spells out that “it is cost-prohibitive to deliver all necessary intiatives [sic] within the upcoming 10 year timeframe”.

The final kicker is that while we focus on the civic centre and waterfront projects, the proposed stadium, road pricing proposal, and three waters infrastructure, the number one issue for Tauranga residents is still not being adequately addressed: transport.

At a recent meeting, we heard that council’s Transport System Plan shows $4 billion of unfunded transport projects, and even if all proceed, congestion will still get worse due to projected population growth.

So let’s get this straight:

- TCC’s net debt is currently nearly twice Christchurch’s debt per ratepayer

- Tauranga ratepayers’ debt will likely increase by over 50% over the next two years

- Unless the new Coalition government allocates huge levels of funding to cover three waters infrastructure, more debt will be required to fund 3 waters capital expenditure

- TCC’s best guess is that once 3 waters is added back in, ratepayer debt will be at least $2.45 million by June 2030 – and that assumes no cost overruns or new projects

- That is all before adding any of the $4 billion of unfunded transport projects

Cutting to the chase, that level of debt is unsustainable. It will breach TCC’s debt ceiling unless rates undergo further massive increases. Yet rates have already increased by 53% under the Commissioners and, despite much bigger increases for Commercial ratepayers, Tauranga’s residential rates are higher than any other NZ city.

Some people believe that debt shouldn’t be a big worry, and it is more important to go ahead and build the exhibition centre and a new stadium. They argue people will just have to pay more, and (in the words of a previous mayor and deputy mayor) some people may need to sell up their property if they can’t afford the rates… and presumably move out of town if they can’t afford the rent increases.

We think that ignores the reality that some people are already stretched close to the financial limit and the projected increases in debt and rates will break them.

The crucial point is this:

The increases in debt and rates are being spent on expensive ‘nice to have’ projects, such as an international exhibition centre and a number of ‘beautification’ projects, rather than on essential infrastructure.

Sustainable BOP believes there are more important priorities, including fixing up our roads, investing in better public transport facilities, reopening a transfer station on the western side of the city, sorting out the industrial pollution at the Mount, helping to enable affordable housing, building more community facilities, and keeping a tighter control of debt so that rates and rents can be more affordable.

Despite the huge rates increases and TCC’s debt tripling over the past six years, the result has been worse congestion, periods of gridlock from unnecessary roadworks, higher carbon emissions, increased homelessness, record house rents, unaffordable housing, and a lack of community facilities.

Perhaps most important of all is that there is now less focus by Council on what most residents want, and more focus on what a small group of business elites and property developers desire.

There’s been no community buy-in to the growth strategy that has driven the huge increases in debt in recent years. TCC admits that ratepayers are funding a sizeable portion of the growth, so it should change its approach to deliver a more sustainable plan that better meets the needs of local residents, protects our natural environment and people’s wellbeing, invests more in essential infrastructure, spends less on ‘nice to have projects’, and keeps the city’s debt to a more manageable level for future generations.

Is this type of financial management bordering on negligence?

If the sports club or a NGO managed their business in the manner of TCC, then they would be sacked or service contracts halted.

I would have hoped that Kim Wallace and Barry Bragg would have withdrawn their involvement from the Precinct build, they are both astute governance champions.

Time will presumably tell how astute, or otherwise, any of the parties have been.